nebraska sales tax rate changes

The Nebraska state sales and use tax rate is 55 055. The original rate of 50.

Covid 19 Pandemic Could Slash 2020 21 State Revenues By 200 Billion Tax Policy Center

March 2022 379 changes February 2022 512 changes November 2021 86 changes Over the past year there have been 982 local sales tax rate changes in states cities and counties.

. Average Sales Tax With Local. 51 rows 75 Sales and Use Tax Rate Cards. Changes in Local Sales and Use Tax Rates Effective July 1 2021 No Changes in Local Sales and Use Tax Rates for October 1 2021.

For tax assistance call 800-742-7474 NE and IA or 402-471-5729. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with. New rates were last updated on 712021.

Effective October 1 2002 Nebraska repeals the sales and use exemption for the following services. Beginning October 1 2002 Nebraska will have several alterations to their sales and use tax system. Effective October 1 2002 the state sales and use tax rate has increased to 55 up from 50.

Changes in Local Sales and Use Tax Rates Effective January 1 2021. Combined Sales Tax Range. 22 rows Over the past year there have been 22 local sales tax rate changes in Nebraska.

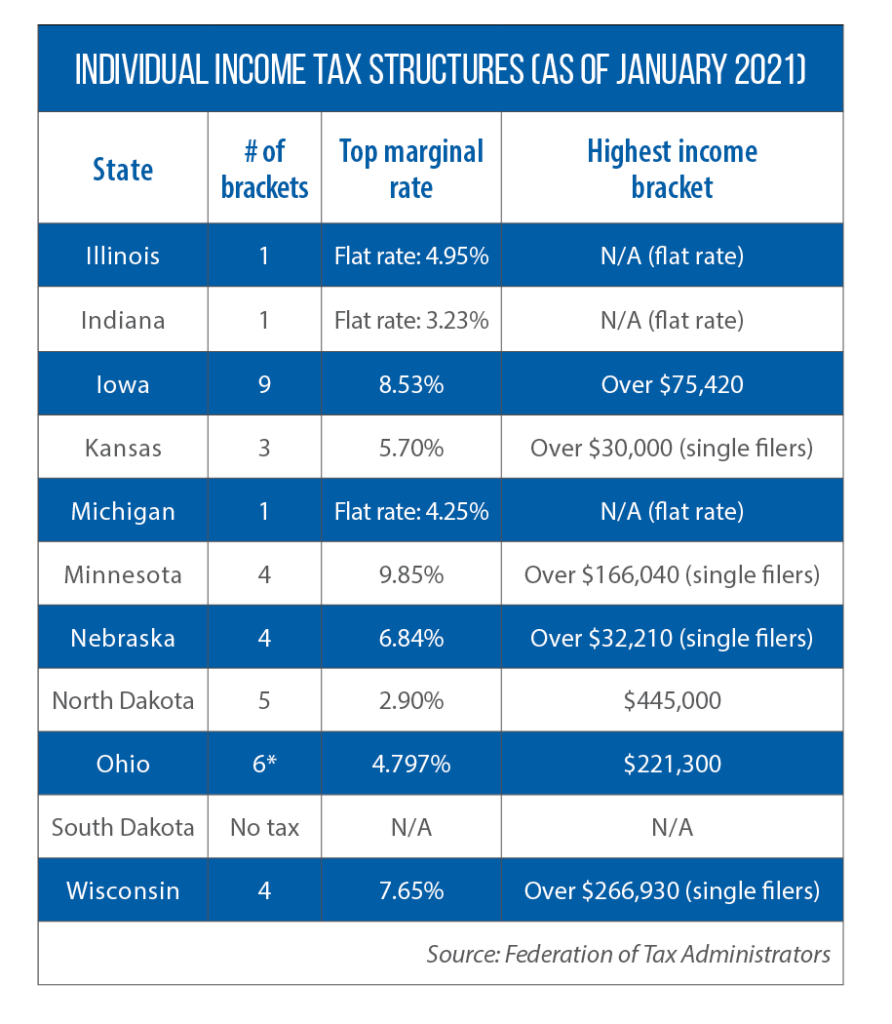

Name address or ownership changes. Nebraska has state sales tax of 55 and allows local governments to collect a local option sales tax of up to 2. LB 873 reduces the maximum tax rate of 684 for the income tax imposed on individuals and fiduciaries for taxable years beginning on or after January 1 2023.

Local Sales Tax Range. The sales tax rate was originally going to be 55 up from 5 from October 1. Nebraska sales tax line 2 multiplied by 055.

The current state sales tax rate in Nebraska NE is 55 percent. This study recommended that business-to-business sales or business inputs be exempt a structural principle that still exists in todays law that is supported by economists as. Nebraska sales and use tax rates in 2022 range from 55 to 75 depending on location.

Base State Sales Tax Rate. A new 1 local sales and use tax takes effect bringing the combined rate to 65. Use our free calculator to determine your exact sales tax rate.

The maximum tax rate for. Local sales and use tax increases to 2 bringing. Avalara Tax Changes 2022.

April 2019 sales tax changes. Building cleaning and maintenance pest control and security. 18 rows Local sales and use tax rate changes have been announced for Nebraska effective October.

Several local sales and use tax rate changes will take effect in Nebraska on July 1 2019. Coleridge Nehawka and Wauneta will each levy a new 1 local sales and use tax bringing the. Nebraska Application for Direct Payment Authorization 122020 20DP.

A temporary rate change has been established in the state of Nebraska.

Taxes And Spending In Nebraska

Nebraska S Marketplace Facilitator Sales Tax Law Explained Taxjar

With Revenue Growth Strong Iowa Nebraska Ohio And Wisconsin Legislatures Cut Income Taxes In 2021 Csg Midwest

Historical Nebraska Tax Policy Information Ballotpedia

Best States For Low Taxes 50 States Ranked For Taxes 2019 Kiplinger

Nebraska Income Tax Ne State Tax Calculator Community Tax

Should We Suspend Gas Taxes To Counter High Oil Prices Econofact

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Nebraska Sales Tax Rate Changes July 2019

Nebraska Sales Tax Rates By City County 2022

State Individual Income Tax Rates And Brackets Tax Foundation

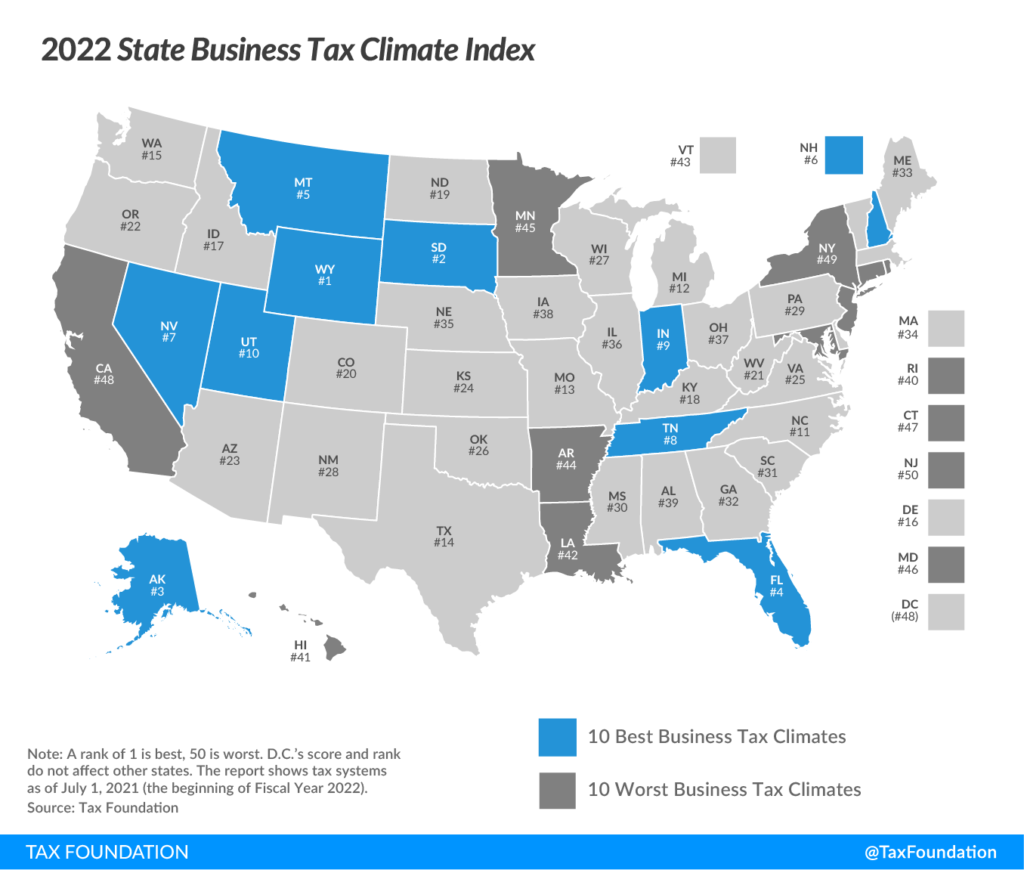

Nebraska Drops To 35th In National Tax Ranking

Nebraska Sales And Use Tax Nebraska Department Of Revenue

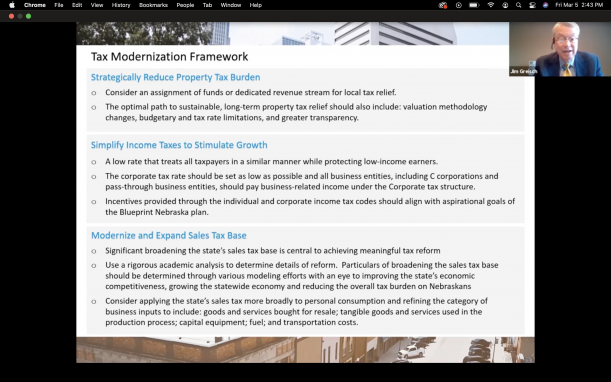

Blueprint Nebraska Outlines Tax Modernization Plan Omaha Daily Record

.png)